[ad_1]

About 10 years in the past, a really thick e-book written by a French economist grew to become a stunning bestseller. It was known as “Capital within the twenty first Century.” In it, Thomas Piketty traces the historical past of revenue and wealth inequality over the previous couple of hundred years.

The e-book’s insights struck a chord with individuals who felt a rising sense of financial inequality however did not have the information to again it up. I used to be one among them. It made me marvel, how a lot carbon air pollution is being generated to create wealth for a small group of extraordinarily wealthy households? Two youngsters, 10 years and a Ph.D. later, I lastly have some solutions.

In a new research, colleagues and I investigated U.S. households’ private duty for greenhouse gasoline emissions from 1990 to 2019. We beforehand studied emissions tied to consumption—the stuff individuals purchase. This time, we checked out emissions utilized in producing individuals’s incomes, together with funding revenue.

Should you’ve ever thought of how oil firm CEOs and shareholders get wealthy on the expense of the local weather, then you definately’ve been pondering in an “income-responsibility” approach.

Whereas it could appear intuitive that these getting wealthy from fossil fuels bear duty for the emissions, little or no analysis has been performed to quantify this. Current efforts have began to have a look at emissions associated to family wages in France, world consumption and investments of various revenue teams and billionaires’ investments. However nobody has analyzed households throughout an entire nation primarily based on the emissions used to generate their full vary of revenue, together with wages, investments and retirement revenue, till now.

We linked a world information set of economic transactions and emissions to microdata from the U.S. Census Bureau and Bureau of Labor Statistics’ month-to-month labor power survey, which incorporates respondents’ job, demographics and revenue from 35 classes, together with wages and investments. Folks’s wages we linked to the emission depth of the industries that make use of them, and we primarily based the emissions depth of funding revenue on a portfolio that mirrors the general financial system.

The outcomes of our evaluation have been eye-opening, and so they may have profound implications for producing simpler and truthful local weather insurance policies sooner or later.

A view from the highest 1%

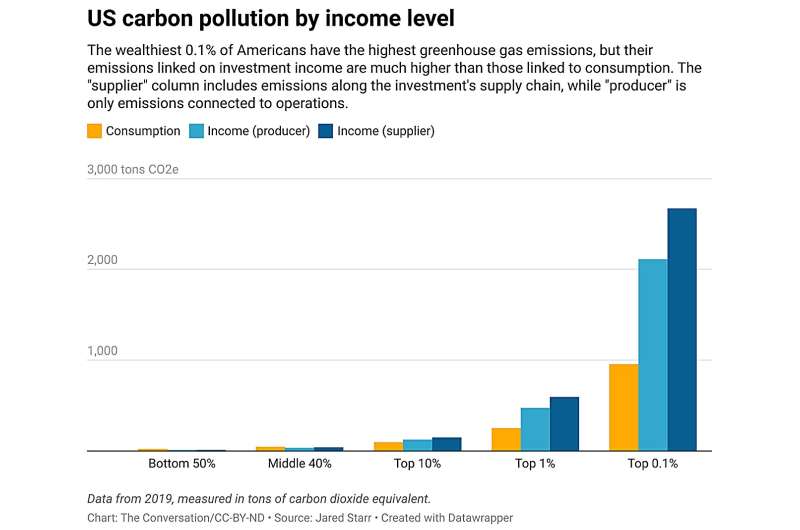

Each our consumption- and income-based approaches reveal that the highest-earning households are chargeable for rather more than an equitable share of carbon emissions. What’s extra stunning is how completely different the extent of duty is relying on whether or not you have a look at consumption or revenue.

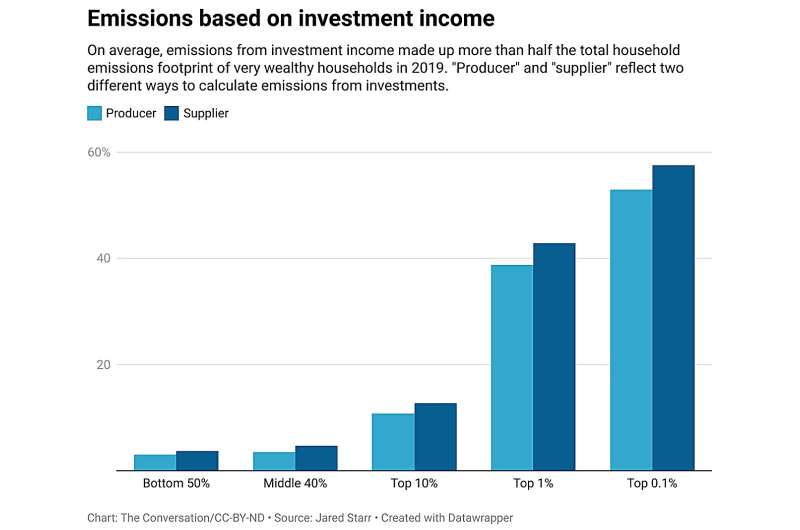

Within the income-based strategy, the share of nationwide emissions coming from the highest 1% of households is 15% to 17% of nationwide emissions. That is about 2.5 instances greater than their consumer-related emissions, which is about 6%.

Within the backside 50% of households, nevertheless, the pattern is the precise reverse: Their share of consumption-based nationwide emissions is 31%, about two instances bigger than their income-based emissions of 14%.

Why is that?

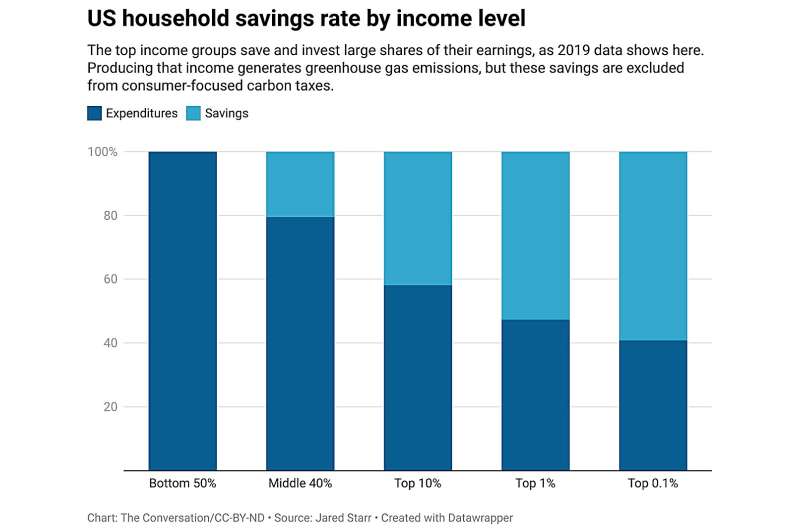

A pair issues are happening right here. First, the bottom incomes 50% of U.S. households spend all that they earn, and sometimes extra by way of social help or debt. The highest revenue teams, then again, are in a position to save and reinvest extra of their revenue.

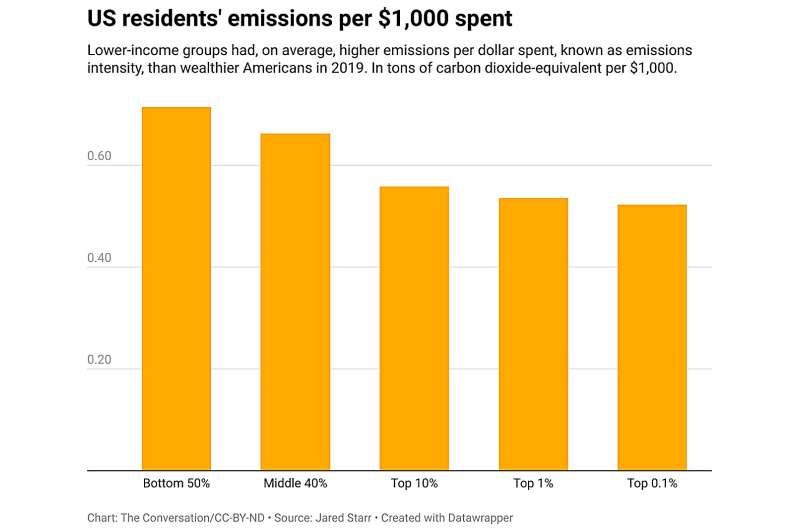

Second, whereas high-income households have very excessive general spending and emissions, the carbon depth—tons of carbon dioxide emitted per greenback—of their purchases is definitely decrease than that of low-income households. It is because low-income households spend a big share of their revenue on carbon-intensive fundamental requirements, like dwelling heating and transportation. Excessive-income households spend extra of their revenue on less-carbon-intensive companies, like monetary companies or greater training.

Implications for a carbon tax

Our detailed comparability may assist change how governments take into consideration carbon taxes.

Sometimes, a carbon tax is utilized to fossil fuels once they enter the financial system. Coal, oil and gasoline producers then cross this tax on to customers. Greater than two dozen international locations have a carbon tax, and U.S. policymakers have proposed including one in recent times. The concept is that elevating the worth of those merchandise by taxing them will get customers to shift to cheaper and presumably much less carbon-intensive alternate options.

However our research present that this type of tax would disproportionately fall on poorer Individuals. Even when a common dividend examine was adopted, consumer-facing carbon taxes haven’t any influence on saved revenue. Producing that revenue doubtless contributed to greenhouse gasoline emissions, however so long as the cash is used to purchase shares quite than consumables, it’s excluded from carbon taxes. So, this type of carbon tax disproportionately impacts individuals whose revenue goes primarily towards consumption.

A profit-focused carbon tax

What if, as an alternative of specializing in consumption, carbon taxes addressed greenhouse gases as an consequence of revenue technology?

The overwhelming majority of American companies function beneath the precept of “shareholder primacy,” the place they see a fiduciary responsibility to maximise revenue for their traders. Merchandise—and the greenhouse gases used to make them—should not created for the good thing about the patron, however as a result of the sale of these merchandise will profit the shareholders.

If carbon taxes have been targeted on shareholder revenue linked to greenhouse gasoline emissions quite than consumption, they may goal these receiving probably the most financial advantages ensuing from these emissions.

The influence

A few attention-grabbing issues may end result, notably if the tax was set primarily based on the carbon depth of the corporate.

Company executives and boards would have incentive to scale back emissions to decrease taxes for shareholders. Shareholders would have incentive, out of self-interest, to stress firms to take action.

Traders would even have incentive to shift their portfolios to less-polluting firms to keep away from the tax. Pension and personal wealth fund managers would have incentive to divest from carbon-polluting investments out of a fiduciary responsibility to their shoppers. To maintain the tax targeted on giant shareholders, I may see retirement accounts being excluded from the tax, or a minimal asset threshold earlier than the tax applies.

Income generated from the carbon tax may assist fund adaptation and the transition to scrub power.

As a substitute of placing the duty for slicing emissions on customers, possibly insurance policies ought to extra immediately tie that duty to company executives, board members and traders who’ve probably the most information and energy over their industries. Primarily based on our evaluation of the consumption and revenue advantages produced by greenhouse gasoline emissions, I consider a shareholder-based carbon tax is value exploring.

Offered by

The Dialog

This text is republished from The Dialog beneath a Inventive Commons license. Learn the authentic article.![]()

Quotation:

A carbon tax on funding revenue could possibly be extra truthful and make it much less worthwhile to pollute, evaluation finds (2023, August 20)

retrieved 20 August 2023

from https://phys.org/information/2023-08-carbon-tax-investment-income-fair.html

This doc is topic to copyright. Aside from any truthful dealing for the aim of personal research or analysis, no

half could also be reproduced with out the written permission. The content material is offered for info functions solely.

[ad_2]